Benefits of Estate Planning

- Eloisa Paulo

- Nov 29, 2023

- 2 min read

Are you ready for the unexpected? If you were to pass away tomorrow, would your family be able to pay the bills and care for themselves? Do you have a will? How about a Living Trust ? Do you even know what Living Trust is? If you do not know these things, it may be time for some estate planning.

Why do you need an estate plan?

Many people postpone estate planning until it is too late, leaving their loved ones with difficult decisions about how to distribute assets after death. Without a plan, the law will decide what happens to the property upon the owner's death and who would care for minor children if both parents died simultaneously. A well-crafted estate plan ensures family members receive what they want and need while preventing costly probate court proceedings after death.

The purpose of estate planning is simple: To ensure that your wishes are carried out after death, protect your assets and leave something behind for those you love. It also helps keep taxes down.

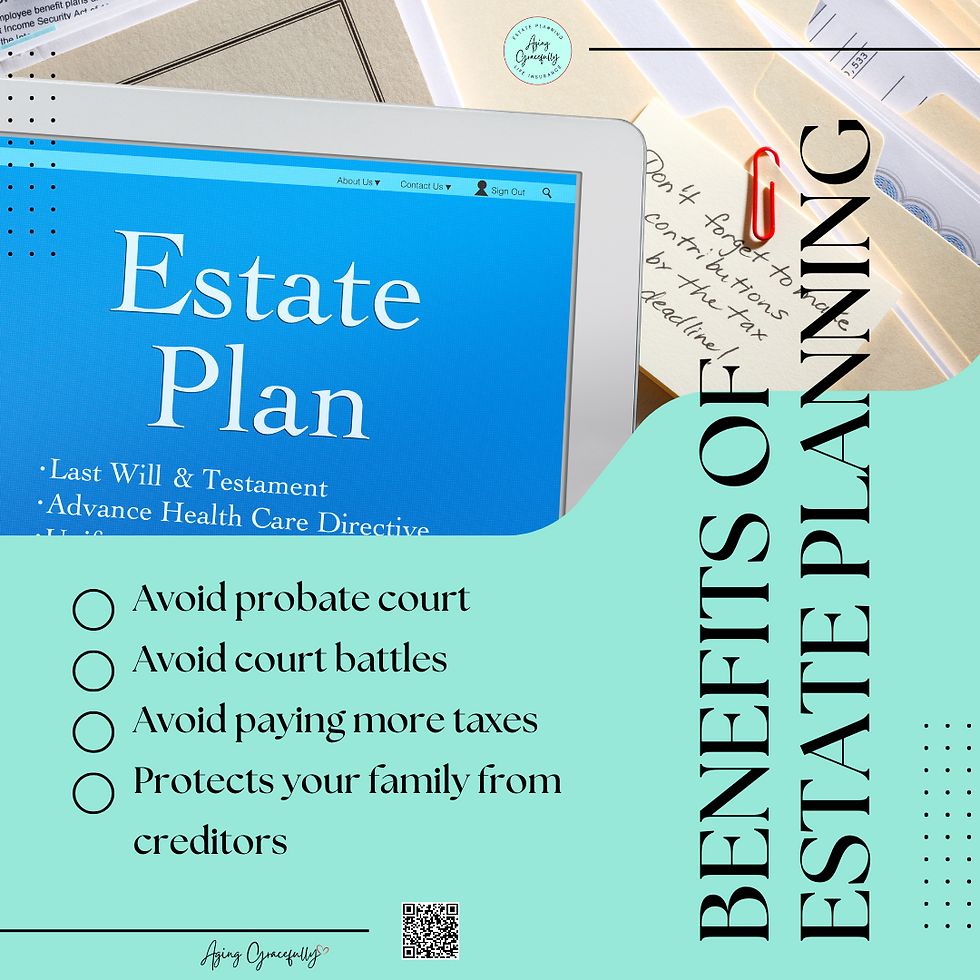

Here are some of the benefits of estate planning:

Avoid probate court costs and delays by having a properly drafted will or trust.

Avoid court battles over who gets what by clearly detailing your wishes in a will or trust.

Avoid paying more taxes than necessary by distributing assets according to your wishes and not necessarily as dictated by state law (although there are some exceptions).

Protects your family from creditors should they need to file bankruptcy after you pass away (for example, if their debts exceed their assets).

A lot of people do not understand that estate planning is not about leaving a large sum of money to their children, giving their pets to their partners, or deciding where they want to be buried. It's about protecting yourself and your family, ensuring they will be taken care of in the event of your death, and planning for the future... regardless of how far away that day may seem. If you are one of those individuals who has been delaying this significant step, please remember that there's nothing wrong with consulting a professional who can help you choose the right estate planning options for your specific needs. Do it soon so it won't be too late.

We provide estate planning services ranging from the creation of wills, trusts, and other estate planning documents for individuals and businesses. In providing these services, we are able to advise you on all aspects of your financial affairs, including the creation of powers of attorney, health care proxies, and other advance directives that allow you to appoint an agent(s) to manage your financial affairs should you become incapacitated or unable to do so.

If you have specific questions about your personal or business estate planning needs, please feel free to contact us and we will be glad to answer your questions. We are here to help and ease your burdens.

Contact us at:

O: 215-233-6107 | C: 267-806-0209

E: OfficeSupport@faithfulhomecare.com

Comments